Listen to this Museletter

Gaming Runs on Dopamine and Ends in GDP

Introduction

The world’s biggest entertainment industry is not film, not music, not even sport; it is gaming. There we said it.

An ecosystem that rewired how humans experience gratification, reshaped global technology stacks, and is now rewriting economic policy from Los Angeles to Riyadh. More than 3.3 billion people log in actively, not just to play, but to learn, compete, earn, and exist in digital worlds that are growing faster than most nations’ GDP.

Gaming today is no longer about consoles or leisure. It is about sovereign wealth funds deploying funds, AI rewriting creativity, and governments building entire economies on play. What began as a pastime is now a central pillar of culture, commerce, and capital.

This edition is a story of power, policy, and the next frontier of human attention.

Agna Insights

Summary

This edition of The Agna Museletter covers how gaming has transformed from entertainment into one of the most powerful systems shaping the global economy.

- Human behaviour

Gaming monetises attention through instant gratification, engaging 3.3 billion players and generating US$184 billion annually, making it the most efficient medium for habit and retention. - Technology

Built on a stack of hardware, software, cloud, and AI, with engines like Unreal and Unity, gaming now anchors computational creativity and real-time scalability. - Capital

Sovereign wealth funds are reshaping the sector, led by Saudi Arabia’s US$55 billion Electronic Arts buyout and US$34 billion committed via Savvy Games Group. - Policy

The UAE and Saudi Arabia are formalising gaming as economic strategy, Dubai targets 30,000 jobs and US$1 billion GDP, while Saudi aims for SAR 50 billion (≈US$13 billion) impact. - Future economy

As XR, AI, and blockchain converge, gaming is set to add US$4.1 billion to UAE GDP and define the architecture of future digital economies.

1. Human Gratification

Why do people keep coming back to games? Because games offer what other forms of entertainment can’t: instant feedback. A movie takes two hours to deliver its payoff. Music builds mood over minutes. Sport demands seasons of waiting. Games condense that reward cycle into seconds.

The appeal of gaming rests on something deeply human: our need for instant gratification.

Most entertainment forms, including film, music, and sport, unfold in hours or days. Games compress that cycle into seconds. A completed quest, a level unlocked, or a loot box reward releases dopamine in real time. This reinforcement loop is what keeps billions of players returning daily, often for short bursts but with high frequency.

For investors, this dynamic matters. Gaming is not just leisure; it is a mechanism that monetises human attention more efficiently than almost any other medium. Every interaction is measurable, optimisable, and monetisable, whether through microtransactions, subscription tiers, or advertising slots. Unlike traditional content, where engagement is passive, gaming thrives on active participation. That distinction is why gaming has surpassed both film and music in global revenues.

The numbers reinforce the point: gaming generates US$184 billion annually, more than the film and music industries combined.

The key insight: gaming is not competing for time the way movies or sports do. It is competing for the neurological circuits that drive habit, loyalty, and spending.

2. The Evolving Tech Stack

Behind every game lies a complex technology stack that encompasses hardware, software, infrastructure, and intelligence. This is where the real investment story lies.

On the hardware front, consoles, smartphones, XR headsets, and lightweight wearables serve as the primary entry points. Each cycle of hardware innovation expands the market: from Nintendo’s Wii Remote motion sensors to Meta’s Quest headsets, each shift enables new formats of play and new categories of users. Chip design, GPUs, NPUs, and energy-efficient processors underpin this growth, making computation faster and cheaper.

Software is the creative layer. Game engines like Unreal and Unity, distribution platforms such as Steam and app stores, and monetisation mechanics including microtransactions, NFTs, and in-game economies. These are no longer just “support tools”; they are recurring revenue machines. The rise of game passes and subscription bundles is evidence that the business model is shifting from one-time sales to long-term, service-based engagement.

Then comes infrastructure. Cloud and edge computing have removed the old bottleneck of latency. Games that once required high-end rigs can now stream to low-cost devices. This democratises access, broadening the total addressable market. Layered on top, blockchain offers verifiable ownership of digital assets and new ways to transfer value between players and platforms.

Finally, intelligence. AI is no longer about smarter NPCs; it now drives adaptive difficulty, personalised storylines, automated content generation, and anti-cheat systems. The ability to algorithmically scale creativity makes AI a multiplier across the stack.

For investors, each layer, hardware, software, infrastructure, and intelligence, functions as an investable frontier. The opportunity is not limited to studios producing titles; it extends to the companies building the rails of the gaming economy itself.

3. Regulatory Havens

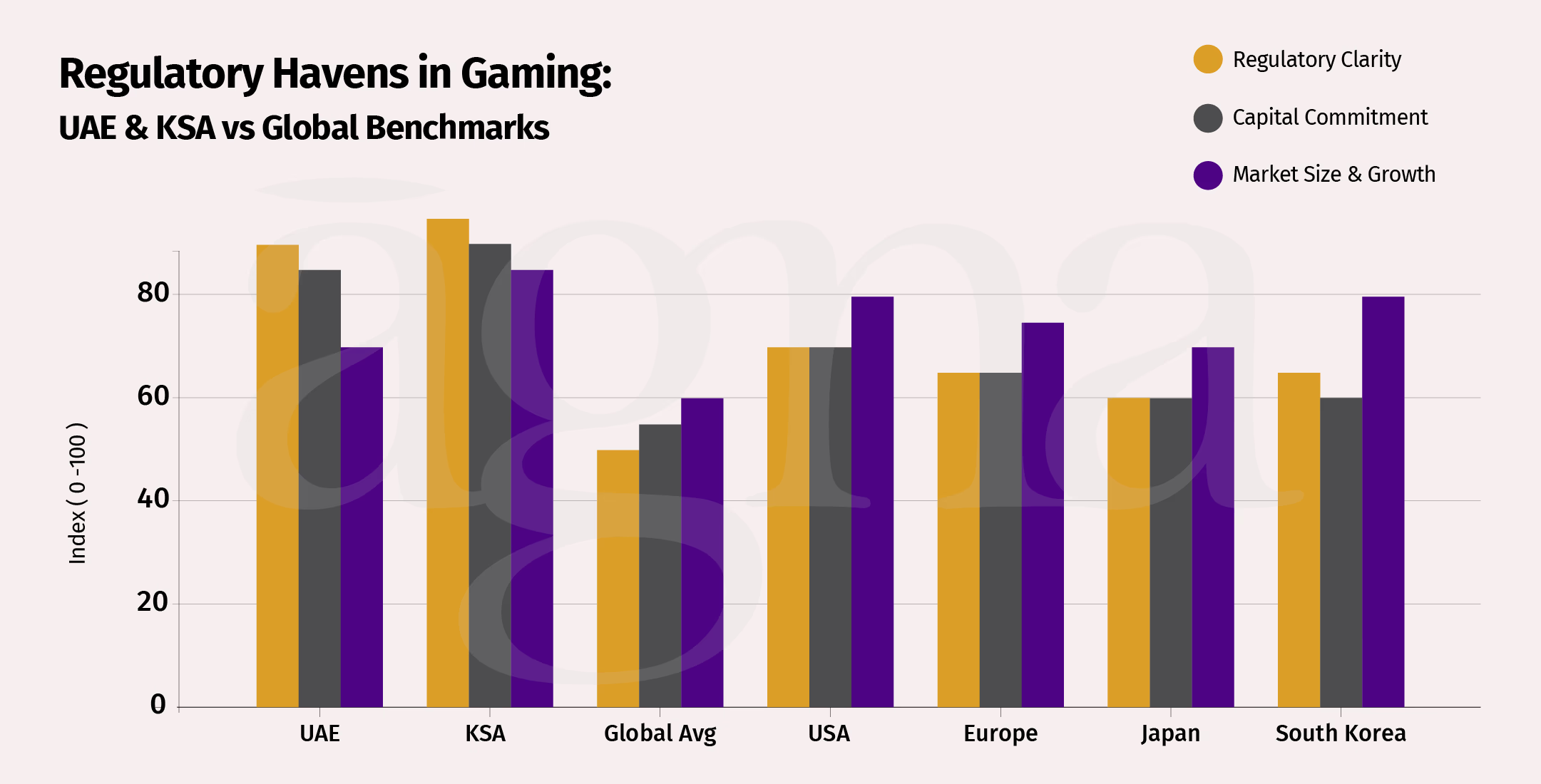

Regulation often makes or breaks industries. In the West, gaming operates within a mature ecosystem shaped by fragmented rules, shifting tax codes, and slower regulatory adaptation. While this maturity reflects decades of industry growth in markets like the US, it also constrains agility. By contrast, the Middle East is pursuing a progressive, forward-looking regulatory approach, positioning itself as the next frontier where policy actively enables gaming, esports, and Web3 innovation.

UAE: Dubai’s Structured Play

Dubai has positioned gaming as a national strategy, not entertainment. The Dubai Program for Gaming 2033 aims to create 30,000 jobs and add US$1 billion to GDP. Dubai Metaverse Strategy extends the horizon, with targets of 40,000 jobs and 1,000 new companies by 2030. These are not loose ambitions; they’re tied directly to funded programs.

The capital is visible and coordinated. Hub71 has allocated US$2 billion for blockchain and gaming startups. The DMCC–Brinc Accelerator adds US$150 million, while sovereign wealth pipelines, ADIA, Mubadala, and the Dubai Future District Fund, reinforce the ecosystem.

Dubai has accelerated its gaming agenda with the 2025 Gamescom pavilion, Dubai Esports and Games Festival, DMCC Gaming Matters, and studio relocations like Gatsby Games, while cross-border bridges such as CV VC x DMCC and Hub71’s US$2.17 billion ecosystem funding reinforce capital flows.

The market itself is healthy. Valued at US$484 million in 2023, it is projected to reach US$754 million by 2030, growing at 6% CAGR. Smartphone penetration exceeds 90%, and average revenue per user (ARPU) is US$95–115, placing the UAE ahead of most emerging markets in monetisation.

Infrastructure and access match the vision. Over 650 gaming licences have been issued, incorporation takes minutes, and taxes are designed to attract, 0% up to AED 375k, 9% above that. Dubai has also issued frameworks for responsible gaming, with deposit caps, mandatory cooling-off periods, and strict ad standards.

Esports sits at the centre of the push. More than US$1 billion is committed to tournaments and leagues. By 2030, AR/VR gaming alone is expected to add US$4.1 billion to GDP and create 42,000 jobs, supported by major investment in data centres, 5G, and digital currency infrastructure.

Dubai currently hosts more gaming companies (350) than Saudi Arabia and Abu Dhabi combined. Beyond scale, it is encouraging original cultural exports, pushing for Arabic mythology and regional folklore to feature in global titles.

Saudi Arabia: Vision Through Scale

Where Dubai moves with precision, Saudi Arabia plays with scale. The National Gaming and Esports Strategy, part of Vision 2030, targets SAR 50 billion (≈US$13 billion) GDP impact and 39,000 jobs. Saudi Arabia now accounts for over a third of MENA’s $6 billion gaming revenue, with 350 million gamers across the region. Women already make up 20% of the esports scene, with 3,000 more expected to turn pro in the next 3–4 years.

Electronic Arts is set to go private in a $55 billion deal led by Saudi Arabia’s PIF, Silver Lake, and Affinity Partners, marking the largest leveraged buyout in history.

The financial base is unprecedented. Savvy Games Group has SAR 129 billion (≈US$34 billion) to deploy, already acquiring ESL and FACEIT to build the world’s largest esports organiser. The Public Investment Fund added US$1 billion into Embracer Group, with another US$1 billion ringfenced for esports infrastructure.

The market is both broad and deeply engaged. 23.5 million Saudis play games, two-thirds of the population. ARPU is above global averages. Participation cuts across demographics: 42% of players are women, and 18% compete in esports.

Execution is highly structured. The NGES outlines 86 initiatives across the value chain: game production, hardware, esports, funding, and talent development. This includes academies, dedicated visas, and purpose-built infrastructure to create capability, not just import it.

Esports is Saudi Arabia’s flagship initiative. With events like Gamers8 and the Esports World Cup, the Kingdom is positioning itself as the global stage for competition. The supporting infrastructure, arenas, ultra-low latency networks, and regional servers cement that ambition.

4. The Need for a Central Node

The global gaming market is fragmented. The US accounts for over 45% of global investment and remains the largest revenue pool at US$67 billion in 2024. South Korea boasts esports penetration of over 70%, with more than 5 million active esports participants. Japan and China together generate 40% of global mobile gaming revenue, while Europe contributes through smaller hubs like Finland, the UK, and Malta, which focus on mobile studios and regulatory arbitrage.

Yet none of these hubs operate as a coordinated centre for capital, regulation, and cultural production. Investment flows remain scattered:

- US$4.3 billion was invested globally in 2024, up 38% YoY, but spread thin across the US, UK, Finland, and Asia.

- The UK attracted US$1.5 billion in gaming and MR deals; Finland has 250+ studios but no capital depth; Malta’s strength is licensing, not scale.

- South Korea’s market is consumer-rich but capital-light.

The Middle East, by contrast, shows concentration and demand. Over 60% of the MENA population is active gamers, mobile game downloads are 50% of total apps (compared with the global average of 40%), and ARPU in the UAE is already US$95–115, among the highest globally. Smartphone penetration exceeds 90%, providing a distribution scale that outpaces many OECD markets.

This creates a structural opening. The UAE can align sovereign capital, regulatory frameworks, and cultural legitimacy in one jurisdiction. It has already issued 650+ gaming licences, created a 10-year Golden Visa for creators, and anchored the industry to sovereign funds and accelerators.

The UAE leads not just regionally but globally, with an ARPU of US$84.60, surpassing even mature markets like the US and China. Saudi Arabia follows at US$54.89, reflecting its rapidly expanding gaming ecosystem under Vision 2030. Together, they anchor the MENA region as one of the most lucrative gaming markets worldwide.

Geographically, it sits between Asia’s 1.7 billion gamers and Western venture and PE capital pools. Culturally, it is the first Middle Eastern government to showcase at Gamescom 2025, signalling intent to lead globally.

For investors, the UAE represents something no other hub offers: the ability to centralise fragmented value chains into a single node. That efficiency and alignment are why Agna is headquartered here.

5. Gaming Today vs Tomorrow

Today, global gaming generates over US$184 billion annually, larger than film and music industries combined. The bulk comes from mobile gaming (≈50% of total revenue), with leading monetisation through ads, live-service models, and in-app purchases. Esports and streaming are secondary layers, but still attract hundreds of millions of monthly viewers, signalling strong engagement but limited direct monetisation.

Tomorrow, the industry will expand into immersive and persistent environments. Extended Reality (XR) devices are projected to reach 100 million active users by 2028, while AI will enable adaptive narratives and hyper-personalised experiences. Interoperable digital assets and tokenised economies are forecast to become a US$100+ billion opportunity by 2030, creating cross-platform monetisation beyond single titles.

AR and VR gaming are expected to contribute US$4.1 billion to UAE’s GDP by 2030 and create 42,000 jobs. On the mobile side, revenue is projected at US$182.8 million in 2025, rising to US$238.3 million by 2030, with an ARPU of US$83.8.

The UAE government’s US$1 billion commitment to esports, coupled with education initiatives that have already engaged 16,000 students and teachers across 250 schools, underlines the long-term talent pipeline being built around gaming.

This evolution opens new investment lanes:

- Synthetic environments

digital twins, metaverse-grade worlds, and simulation platforms. - Creator tools

engines, middleware, and AI-assisted design enabling independent developers. - Neuro-gaming

computer interfaces and biometric feedback systems, projected to grow at a 15% CAGR over the next decade.

The strategic question for capital allocators is where to anchor conviction: studios with proven IP, infrastructure that scales ecosystems, or platforms that orchestrate both.

Story: Three Generations of Play

Elena was born in the 1940s.

She remembers long afternoons spent around a table with her family, dice in hand and laughter in the air. Chess, Scrabble, and Monopoly defined her youth.

For Elena, games were not about technology but about togetherness. The gratification came in simple forms: the satisfaction of a clever move, the joy of winning after hours of strategy, or the humour of a family squabble over rules.

Games ended when the pieces were packed away. They created memories, taught patience, and strengthened bonds, but they never intruded beyond the moment.

Her daughter, Sophia, grew up in the 1980s and 1990s, curious about Elena’s board games yet captivated by a new frontier: digital play.

At first, it was 8-bit consoles and cartridge games. Then came the rise of the PC, hours spent in LAN cafés playing Counter-Strike, evenings lost to World of Warcraft raids, and eventually mobile titles like Candy Crush that fit into the pauses of daily life.

For Sophia, the gratification cycle had shortened dramatically. She could play anywhere, anytime. Games became companions rather than rituals.

But with that freedom came new risks. The “just one more level” impulse meant late nights, eye strain, and sometimes an imbalance between life and play.

What had once been finite in her mother’s generation became potentially endless. Yet the other side of that coin was extraordinary: Sophia built friendships across continents, discovered problem-solving skills through gameplay, and witnessed gaming grow from pastime to global industry.

Now comes Mira, Sophia’s daughter. She is ten years old, and for her, gaming is not a pastime but a framework of life.

When Mira wakes in Dubai, she slips on her lightweight XR glasses. Instantly, her window view becomes her dashboard: school assignments layered over the skyline, quests tied to her daily routine, and notifications from her international friends.

In the morning, her science class takes place inside a neuron, where AI tutors shift the pace and complexity of the lesson depending on her progress.

By midday, Mira is earning tokens by designing digital artefacts that can be traded securely on the blockchain. In the afternoon, she competes with a team: Amal from Riyadh, Ji-hoon from Seoul, and Daniel from San Francisco. Together, they explore a dynamically generated world where AI engines craft unique challenges, blending Arabic folklore, Korean myth, and American comic traditions into a single narrative.

For Mira, gaming is work, education, community, and cultural exchange. Yet the system she inhabits recognises the risks that her mother’s generation faced. Responsible gaming is embedded into her world by design. Her XR headset enforces rest cycles, biometric sensors alert her when she has played too long, and AI companions nudge her to step away, stretch, or spend time outdoors. Play remains immersive, but not infinite. Gratification is instant, but sustainable.

Elena once taught patience through board games. Sophia learned both the thrill and the danger of an always-on digital world. Mira now lives in a balance: play that fuels learning, work, and creativity without tipping into excess.

Across these three generations, the meaning of gaming has transformed.

For Elena, it was finite and familial.

For Sophia, it became global yet unbounded.

For Mira, it is embedded in every aspect of life, but guided by systems that keep it healthy.

Gaming today is not simply entertainment. It is education, advertising, the creative industry, a cultural bridge, and an economic driver. It connects billions across geographies, shaping how humans learn, work, and build community. The future lies not in limiting play, but in ensuring it remains sustainable, immersive enough to inspire, and balanced enough to endure.

6. Closing Note

Gaming is no longer niche entertainment; it is a US$187 billion global industry projected to exceed US$230 billion by 2030 at 9% CAGR. Over 3.3 billion people, 40% of the world’s population, are active gamers. Esports alone is forecasted to generate US$4.3 billion in revenues by 2030, with an audience surpassing 700 million.

For investors, value is shifting beyond studios. Growth lies in the infrastructure of play, cloud gaming (US$18 billion by 2030), AR/VR (US$52 billion by 2028), blockchain-enabled economies (US$65 billion by 2027), and the platforms that govern virtual ecosystems.The UAE is positioning itself at this intersection. With sovereign funds, accelerators, and regulatory clarity, it is the only geography actively building gaming as a national economic pillar. Its location bridges Asia’s 1.7 billion gamers with Western capital pools, and its policy provides a stable runway for creators and investors alike.

Agna Updates

- DIFC made an official announcement recognising Agna’s role in backing frontier founders and advancing DeepTech innovation across the East–West corridor. Building on this, Agna framed DeepTech as the new infrastructure of a multipolar world, consistent with its Paradigm Shift Thesis rooted in data, engineering, and conscious capital.

- At Preqin’s webinar on The Rise of Private Capital in the Middle East, our Founder, Pranav Sharma joined industry leaders to discuss how the region’s capital is moving from peripheral exposure to a core global allocation, validating Agna’s East–West investment thesis.

Listen to this Museletter

Questions? Feedback? Different perspective?

We invite you to engage with us and collaborate.

Warm Regards,

Team Agna

Click below to join our mailing list for The Agna Museletter.

Agna Capital Limited is regulated by the Dubai Financial Services Authority