Listen to this Museletter

Framework for DeepTech Maturity and Year End Gratitude

Introduction

DeepTech shapes power, productivity, and sovereignty. The difference between breakthrough and dominance is rarely the science. It is the system that carries scale.

Across energy, defence, life sciences, and compute, technologies advance faster than the institutions, factories, and markets required to absorb them. Capital flows early. Capability arrives late. The gap between the two defines outcomes.

Readiness at scale is not a milestone. It is coherence.

Agna Ascent1 introduces a national framework for DeepTech readiness built around this insight. It treats Technology, Manufacturing, and Commercial Readiness as interacting capacities whose alignment determines whether innovation compounds or stalls under real capital constraints.

The framework is designed for decision-makers operating where timing matters more than novelty. It shifts readiness from a descriptive label to a decision variable and makes coordination risk visible before scaling begins.

This is a framework for investing, building, and governing DeepTech in systems that carry ambition through to durable capability.

Agna Insights

From Maturity to Coherence: A National Framework for DeepTech Readiness

Agna Ascent and the DeepTech Trilemma

Every DeepTech breakthrough begins small, often inside a laboratory, a defence programme, or an early-stage company. At this level, readiness is typically assessed through Technology Readiness Levels (TRL) and Manufacturing Readiness Levels (MRL), alongside commercialisation or market readiness frameworks. At Agna, we refer to this adoption and market layer as CRL (Commercial Readiness Level). Together, these readiness lenses help determine whether a specific technology can move from prototype to market.

They are useful project-level tools, but they are incomplete for investment judgment in complex systems.

As technologies begin to shape national supply chains, energy systems, and security architectures, the nature of readiness changes. The core question is no longer whether a technology works in isolation. It is whether the surrounding institutions, production systems, and markets can absorb, scale, and sustain it within a reasonable capital and time envelope. This is where many technically strong investments lose momentum, not because the science breaks, but because the system does.

This Museletter proposes Agna Ascent, a national coherence framework for DeepTech readiness. Its purpose is practical. It is designed to help institutional investors, policymakers, regulators, ecosystem builders, and industrial leaders make more defensible decisions in environments where capital is exposed not only to technical risk, but also to coordination risk.

Why micro readiness breaks at system scale

Micro readiness frameworks answer a narrow question: can a specific technology move from idea to market within a single organisational boundary? They work well when technologies scale in isolation. They fail when multiple technologies scale simultaneously across shared infrastructure, regulation, and supply chains. This is precisely the condition that defines modern DeepTech investing.

At the project level, TRL tests whether the science works, MRL whether it can be built, and CRL whether customers will adopt it. These are feasibility checks. They assume that constraints are largely internal to the firm. Once technologies begin to shape sectors such as energy, compute, life sciences, or national security, this assumption breaks down. Progress in one domain starts to alter conditions in another, creating interdependencies that project-level metrics cannot detect.

This matters for investment because concurrency changes risk. When several technologies scale simultaneously, they compete for the same fabrication capacity, regulatory attention, talent pools, and procurement budgets. A company can appear investable on micro metrics while being exposed to bottlenecks that only emerge at the system level. These bottlenecks are rarely technical. They are institutional, industrial, or political.

In observed case patterns, many venture losses in DeepTech arise not from technical failure, but from factors such as institutional blockage, timing mismatch, underestimated capital intensity, or ecosystem dependence. TRL-centric analysis can overemphasise proof-of-concept while underemphasising manufacturing bottlenecks, regulatory hurdles, procurement inertia, and the durability of adoption pathways. The result is not a bad technology. It is a mispriced system.

What Conventional VC Analysis Misses

In practice, many DeepTech investment failures stem from recurring analytical blind spots rather than poor technology selection. Conventional VC analysis often struggles with:

- False positives driven by technical novelty, where proof-of-concept is mistaken for investability

- Late discovery of regulatory, institutional, or integration blockers that surface only after capital is committed

- Systematic misjudgement of timing and capital intensity in multi-stakeholder environments

- Over-reliance on founder narratives that underweight non-technical path dependencies

- Underestimation of ecosystem lock-ins, including manufacturing inertia, procurement behaviour, and policy lag

Agna Ascent is designed explicitly to surface these failure modes earlier, before they harden into delays, dilution, or dependency risk.

Introducing Agna Ascent: readiness as coherence

Agna Ascent is a DeepTech coherence framework designed to address this gap. It extends readiness analysis beyond individual technologies to the systems that determine whether those technologies become investable, scalable, and structurally resilient.

The framework examines how research capability, manufacturing capacity, and market adoption evolve relative to each other, and where misalignment introduces hidden risk. It focuses on measurable signals such as conversion rates, infrastructure density, procurement behaviour, and the symmetry or asymmetry of readiness across domains.

The shift is simple but important. Readiness stops being a descriptive label and becomes a decision variable. It is no longer about how advanced a technology appears at a point in time. It is about whether the system around it is moving in step, or quietly setting up constraints that only surface once capital is already exposed.

Agna Ascent differs from conventional readiness frameworks in a small number of deliberate design principles. Readiness is treated as contextual rather than absolute. Progress is understood to be non-linear and asymmetric. Risk emerges from interactions between domains rather than from any single component. Most importantly, investment relevance is determined by timing and capital exposure, not by end-state technical maturity.

At the national or ecosystem scale, TRL, MRL, and CRL no longer describe project milestones. They describe structural capacity.

- Technology Readiness reflects depth of discovery: sustained R&D intensity, density of testbeds and pilot facilities, and the ability to convert research output into working prototypes. Patent volume alone is insufficient. The more relevant signal is conversion efficiency, how often published research moves into applied development within a defined time window. High TRL without conversion capacity signals future bottlenecks rather than an advantage.

- Manufacturing Readiness reflects industrial adaptability rather than scale. In DeepTech, value is created through precision, modularity, and reconfigurability. Investment risk rises when manufacturing systems require long retooling cycles, rely on narrow supplier bases, or lack pilot-scale facilities. Strong MRL often shows up as rapid line reconfiguration, supplier redundancy, and capital-efficient scaling pathways that reduce exposure during early deployment.

For software-led DeepTech systems, the equivalent constraint is deployment adaptability rather than code maturity. Risk rises when software requires bespoke integrations, rigid data dependencies, or environment-specific rewrites to move from pilot to production. Strong readiness shows up as modular architectures, standardised interfaces, and repeatable deployment across customers, jurisdictions, and operating environments, allowing scale without linear increases in engineering effort, compliance burden, or capital exposure. - Commercial Readiness reflects the ability of markets to absorb innovation predictably. This includes procurement behaviour, regulatory clarity, financing depth, and export integration. CRL is not a demand in the abstract. It is a demand that can be accessed without excessive delay, uncertainty, or bespoke compliance cost. Weak CRL often reveals itself late, after capital has already been deployed into capacity that cannot be utilised.

Agna Ascent deliberately constrains its readiness dimensions. While organisational, societal, and geopolitical factors matter, TRL, MRL, and CRL are chosen because they most directly shape timing, capital intensity, and scalability in DeepTech investment. Other factors are treated as contextual modifiers rather than core dimensions, preserving analytical clarity and investment relevance.

These dimensions interact continuously. When public R&D spending rises without parallel investment in prototyping infrastructure, TRL advances while MRL stalls. When industrial parks expand faster than research pipelines, manufacturing capacity exceeds differentiation. When markets liberalise before domestic capability matures, adoption favours imported solutions. Each pattern creates a different class of investment risk.

Agna Ascent is built to surface these risks earlier, before capital is committed at scale.

Coherence as an analytic construct

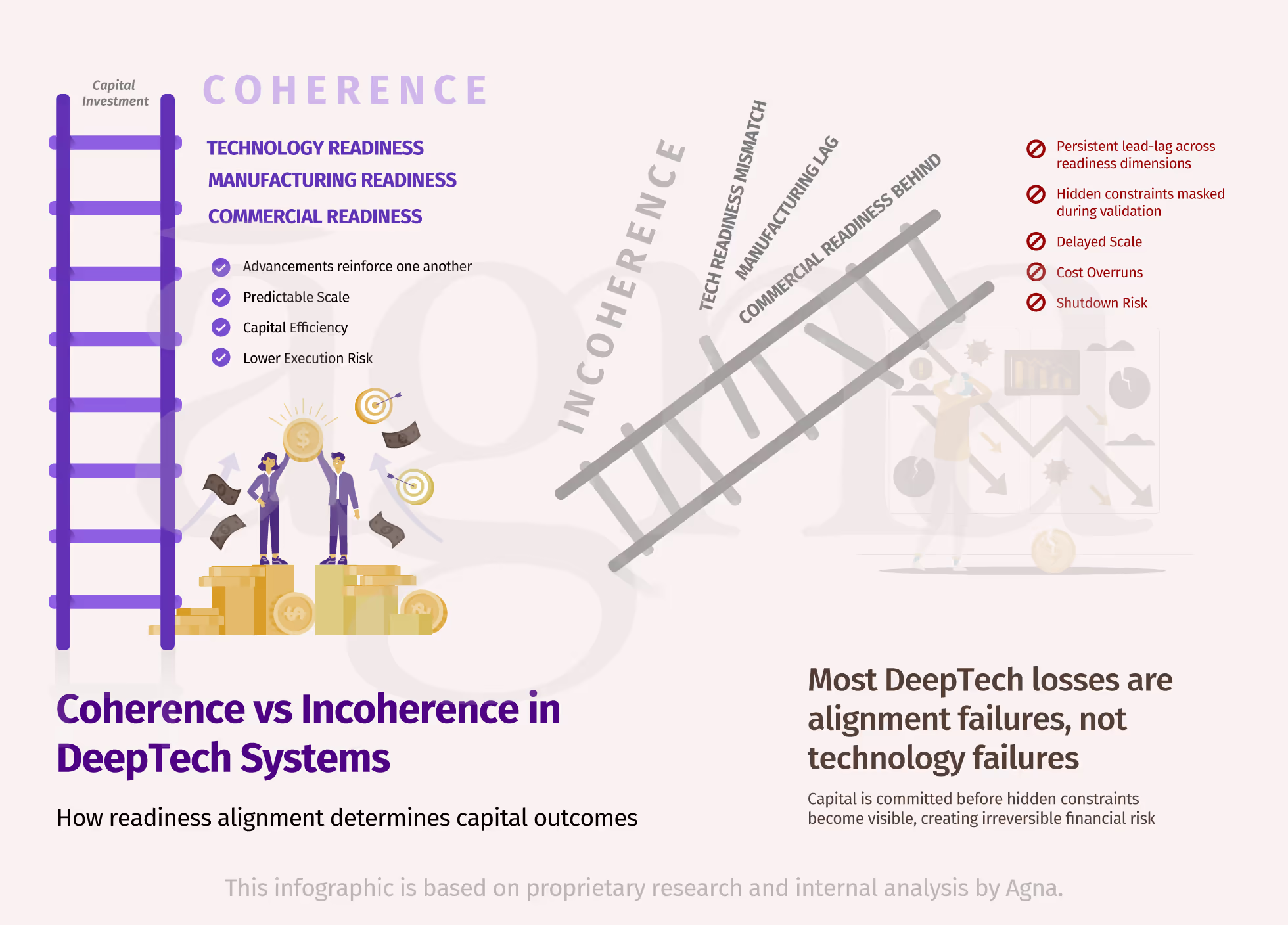

At the centre of Agna Ascent is the idea that readiness is not additive. Technology, manufacturing, and markets do not mature independently and then sum to capability. Their interaction determines whether progress compounds or dissipates.

Coherence, in this framework, is defined as the relationship between the rate and direction of change across TRL, MRL, and CRL.

Coherence is observable. It appears when readiness dimensions advance at compatible speeds and reinforce one another. Incoherence appears when one dimension leads or lags persistently, creating constraints that surface only after capital is committed. This distinction is critical for investment judgment because most DeepTech losses arise from misalignment rather than technical failure.

In practice, incoherence manifests as distinct classes of investment risk. Persistent divergence between readiness dimensions can signal timing mismatch, capital misalignment, organisational overreach, or ecosystem dependency risk, depending on which dimension leads or lags and why.

Agna Ascent treats coherence as a diagnostic, not a score. Four recurring readiness patterns are used to interpret alignment:

- Aligned readiness occurs when research output, production capability, and market access progress in step. These systems support predictable scale-up and clearer capital planning.

- Leading readiness occurs when one dimension, most often TRL, advances faster than the others. This can create the illusion of momentum while pushing manufacturing or adoption risk into the future.

- Lagging readiness occurs when downstream constraints remain hidden until late stages. Regulatory backlog, procurement inertia, or fabrication bottlenecks often fall into this category.

- Fragmented readiness occurs when signals contradict each other across domains. Strong research can coexist with weak supply chains, or active markets can depend on external innovation. These environments are the hardest to underwrite.

These patterns change how risk should be priced. Aligned systems reward conviction. Leading systems require patience and staged exposure. Lagging systems demand caution. Fragmented systems often warrant avoidance until structural conditions change.

Coherence also evolves over time. The framework tracks whether gaps between readiness dimensions are narrowing or widening. Direction matters more than position. Improving alignment reduces future capital risk. Deteriorating alignment increases the likelihood of delay, dilution, and dependency.

The Ascent Spiral: readiness as renewal, not a checklist

Readiness, in this framework, is cyclical rather than sequential.

Discovery feeds production. Production enables adoption. Adoption generates capital, data, and feedback that renew discovery. When this cycle is intact, innovation becomes self-reinforcing. When one layer weakens, the cycle stalls, and capital efficiency deteriorates.

The Ascent Spiral captures this dynamic. It shows how value is created not by advancing a single phase quickly, but by keeping energy circulating across discovery, production, and adoption. For investors, the spiral functions as a timing lens. Systems with strong circulation support repeatable scale. Systems with leakage require additional capital, patience, or external support to compensate.

This reframes DeepTech from a race of invention to a cycle of sustained renewal.

Technologies that sit inside coherent systems benefit from faster learning loops, clearer procurement pathways, and more predictable capital requirements. Technologies embedded in fragmented systems face repeated resets as constraints emerge late.

The practical implication is timing. Coherent systems allow investors to underwrite scale with greater confidence. Incoherent systems require patience, staged exposure, or avoidance altogether. Agna Ascent does not promise higher returns by backing more advanced technology. It improves outcomes by backing technology in systems that are ready to carry it.

The DeepTech Trilemma: why maturity does not reliably translate into investability

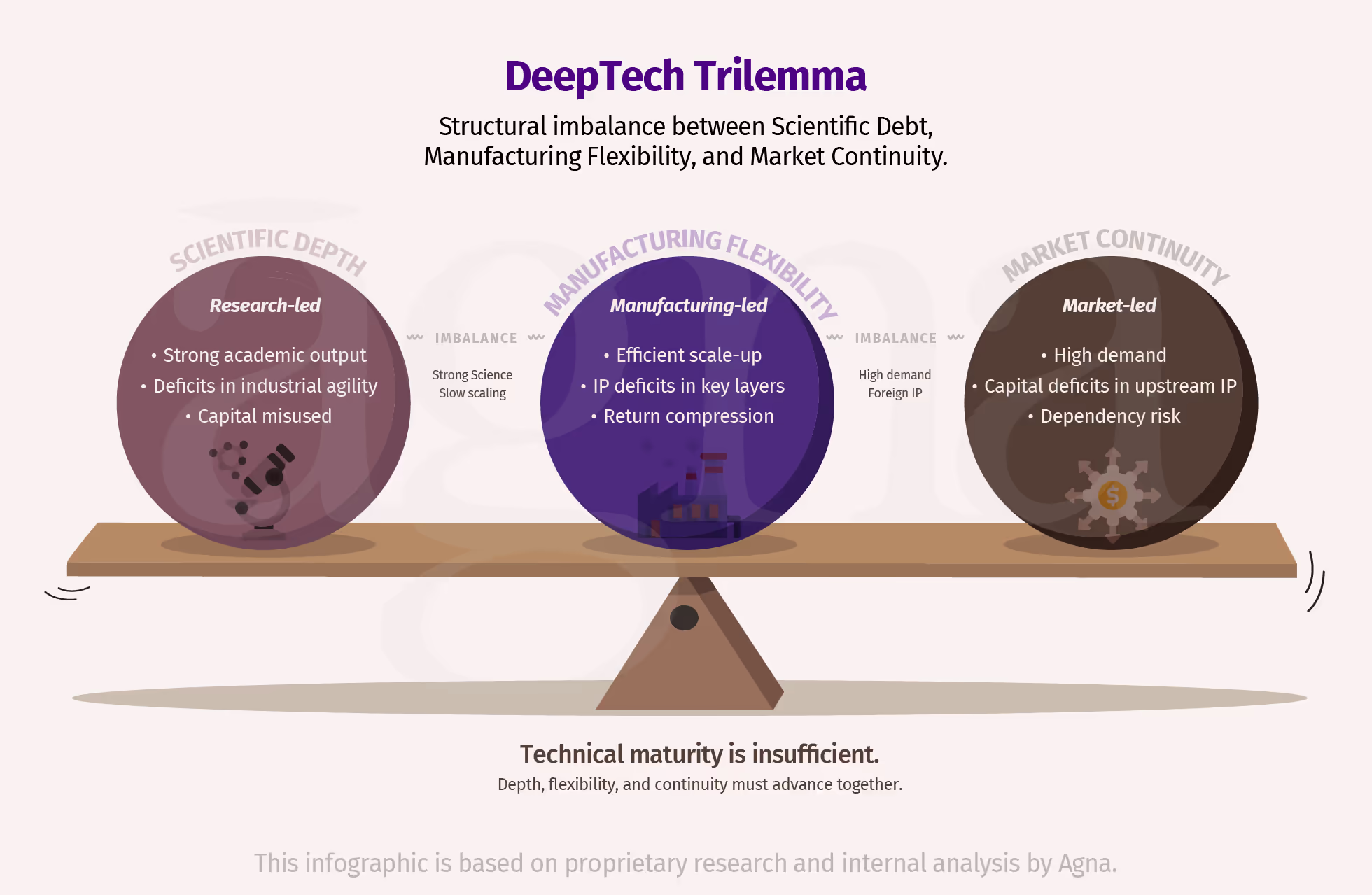

Most national innovation systems exhibit a structural imbalance between three capacities:

- Scientific depth

- Manufacturing flexibility

- Market continuity.

Few countries sustain all three at high levels simultaneously, and fewer still keep them aligned over time. Each capacity depends on different institutions, infrastructure development, capital cycles, and talent flows, which means progress is usually uneven. This imbalance is not theoretical. It is a recurring source of investment risk in DeepTech.

Research-led systems often generate strong science but lack the industrial agility required to translate discovery into deployable products. Manufacturing-led systems can scale production efficiently but rely on external intellectual property and upstream innovation. Market-led systems display strong demand and capital availability but frequently depend on imported technologies to satisfy that demand. The DeepTech trilemma captures this pattern and explains why technical maturity does not reliably translate into investability.

This imbalance matters because capital is typically deployed at the point where these systems intersect.

- When scientific capability runs ahead of manufacturing readiness, investors often face long delays, cost overruns, and repeated redesign cycles during industrialisation.

- When manufacturing capacity scales faster than original research, returns can compress if differentiation is weak and competitors converge.

- When markets absorb faster than domestic innovation develops, dependency risk can rise, and strategic control can weaken, particularly in strategic sectors.

The trilemma is visible in current global dynamics.

Countries with world-class research infrastructure often face constraints in modular and reconfigurable manufacturing in frontier DeepTech sectors. The United States and parts of Europe, for example, lead in advanced research and venture-backed innovation, yet remain dependent on offshore manufacturing for critical components such as advanced semiconductors, precision electronics, and certain biomanufacturing processes. Though a lot of prioritisation is being given to near-shore or localised critical supply chain ecosystems.

Economies with highly flexible and scalable factories frequently depend on external sources of upstream discovery, design tools, or foundational intellectual property in specific technology layers. Manufacturing-led hubs in East Asia have built exceptional process efficiency and yield optimisation, while retaining selective dependencies on foreign research ecosystems and core IP in areas such as advanced lithography, materials, and design automation

Capital-rich markets further illustrate the imbalance. Regions with strong demand, state-backed capital, and clear strategic ambition, including parts of the Gulf and East Asia, continue to import core DeepTech technologies as domestic research and industrial capabilities mature.

These gaps are not merely transitional. They are structural features of national innovation systems, shaped by institutional incentives, capital cycles, and talent flows. They meaningfully influence where DeepTech investment compounds sustainably or stalls under coordination risk.

Agna Ascent treats the trilemma as an investment diagnostic, not a policy observation. It shifts readiness from a binary question of technical feasibility to a systemic assessment of whether discovery, production, and adoption are advancing at compatible rates. Where they are not, the framework identifies the form of misalignment and the risk it creates.

Depth, flexibility, and continuity are not attributes to be maximised independently. They are variables that must move in proportion.

When one dimension leads too far ahead of the others, apparent progress can mask future bottlenecks. The trilemma makes these timing mismatches visible before they surface as capital and opportunity losses.

From micro to macro: how national readiness creates investment failure modes

Structural imbalance is the norm. Research agencies, industrial ministries, and market regulators operate on different timelines and incentives. Funding can accumulate upstream in laboratories while prototyping and pilot infrastructure lags. Industrial capacity can expand ahead of innovation pipelines, eroding differentiation. Markets can open before domestic capability is ready, increasing dependence on imported technology. These gaps are where investment risk concentrates.

Agna Ascent captures this interaction explicitly. It measures not only progress within each readiness dimension, but also the conversion loss between them.

- When TRL accelerates without matching MRL, scientific output accumulates without deployment.

- When MRL leads without TRL, capacity outpaces originality.

- When CRL advances without domestic depth, adoption favours external suppliers.

For investors, this changes the signal set. The question is no longer whether a company can execute its roadmap. It is whether the system it depends on is moving in the same direction, at a compatible pace, with manageable capital exposure. This is the point where readiness stops being a technical label and becomes a timing and risk assessment tool.

In several cases we have observed, technologies that appeared advanced on project-level readiness stalled for years at scale due to pilot-manufacturing bottlenecks or procurement inertia that were invisible at the firm level but decisive at system scale.

How Investment Judgment Is Formed

Agna Ascent is not a scoring model. It is a structured judgment framework. Signals are synthesised rather than averaged.

At early stages, qualitative indicators and directional signals carry greater weight, particularly around institutional alignment, regulatory posture, and manufacturing optionality. At later stages, evidence of conversion, procurement behaviour, and capital efficiency becomes decisive.

Contradictory indicators are not resolved mechanically. Divergence is treated as information. In some cases, qualitative judgment appropriately overrides quantitative signals, particularly where policy timing, security constraints, or ecosystem dependencies dominate outcomes.

Within this logic, Agna Ascent distinguishes between red flags, which materially impair scale potential, and monitor conditions, which warrant staged exposure rather than immediate exclusion. In practice, the value of readiness assessment lies less in precise scoring than in disciplined comparison, explicit assumptions, and early detection of divergence across dimensions.

Country-level signals illustrate this clearly (non-exhaustive). India has accelerated research and mission-oriented innovation capacity across institutions such as IITs, IISc, and ISRO, yet translation from prototype to scalable manufacturing remains uneven in several DeepTech domains, often constrained by pilot-scale capacity, specialised tooling, and supplier readiness, with MRL becoming the binding constraint. Japan presents a different profile. Industrial capability remains world-class, while the growth rate of certain frontier research pipelines can vary by sector and demographic realities. Both environments can be investable, but they require different strategies for timing, partnerships, and scale-up risk.

A moderate but converging system is often more investable than an advanced but fragmenting one.

The East–West Corridor: coherence across regions as a readiness-sharing structure

Few economies combine deep research capability, flexible manufacturing, and continuous market absorption within a single system. This structural imbalance defines the DeepTech trilemma and explains why technological leadership and value capture often diverge.

The East–West Corridor is Agna’s response to this structure. It is not a trade route or a geopolitical alliance. It is a framework for distributing readiness across systems that hold complementary strengths.

Research ecosystems in Europe and North America provide discovery depth. Scale-up manufacturing hubs across Asia provide production capacity in selected sectors. The Middle East, particularly the UAE, KSA, and Israel, provides the bridging layer, with the UAE serving as the fulcrum of the East–West Corridor through the flow of technology, capital, talent, and information, supported by a progressive regulatory environment and patient capital. Demand growth across South Asia, wider Asia, and parts of Africa provides market pull and operational feedback, depending on the technology domain.

From an investment perspective, the corridor reduces single-point dependency. A technology conceived in one ecosystem, prototyped in another, fabricated in a third, and deployed in a fourth can benefit from diversified risk and faster learning loops. Capital efficiency improves when no single geography must carry the full burden of readiness at once.

The corridor operates through three forms of alignment:

- Scientific exchange linking testbeds, standards, and validation pathways.

- Manufacturing modularity enabling cross-border production without long retooling cycles.

- Policy synchronisation reducing friction around intellectual property, export controls, and capital movement.

Practically, this can take the form of shared testbeds, co-production pathways, aligned certification standards, and procurement reciprocity in selected domains.

Over time, this structure supports a shift from dependency to interdependence. Nations specialise without becoming subordinate. Investors gain exposure to systems that are resilient by design rather than protected by scale alone.

The central claim is practical. Future sovereignty and future returns will accrue to systems that integrate deeply, not those that merely innovate quickly. The East–West Corridor operationalises this principle by turning coherence into a shared asset rather than a local constraint.

Outcomes and decision relevance

Agna Ascent produces three distinct outcomes, each relevant to a different class of actor. The distinction matters because DeepTech fails for different reasons depending on who is acting without alignment.

For governments, the framework exposes where innovation pipelines break down between research funding, industrial capacity, and policy execution. These breaks are often invisible in aggregate spending data, yet they determine whether public investment produces capability or only activity.

For investors and industrial leaders, the value lies elsewhere. The framework highlights where capital can improve coherence rather than accelerate imbalance. In DeepTech, speed without alignment increases risk. Faster funding into a misaligned system can amplify delays, cost overruns, and dependency on external actors. Agna Ascent helps identify when capital is likely to compound progress, and when it is likely to encounter structural drag.

For multinational coordination, the framework enables collaboration rather than duplication. The corridor lens helps link complementary strengths across regions, reducing the need for single-system self-sufficiency and lowering coordination risk at the point of scale.

The practical implication is timing. Coherent systems allow investors to underwrite scale with greater confidence. Incoherent systems require staged exposure, conditionality, or delayed entry. Agna Ascent improves outcomes by backing technology in systems that are ready to carry it.

Policy relevance: coherence as an investment variable

Policy is not a backdrop to DeepTech investment. It is a material input into timing, capital exposure, and execution risk. In sectors with long development cycles and high fixed costs, misaligned policy increases uncertainty more than weak demand or technical setbacks. Agna Ascent treats policy coherence as an investment variable, not a governance preference.

Effective policy does not maximise activity. It reduces friction between discovery, production, and adoption. The priorities below are structured across three horizons because readiness failures occur at different points in time, and capital reacts differently at each stage.

Immediate priorities focus on mitigating early coordination risk:

- Integrated research and manufacturing testbeds to shorten the distance between discovery and fabrication.

- National readiness observatories to create transparency around whether alignment is improving or deteriorating.

- Procurement alignment so governments act as early customers for domestic innovation and make CRL more predictable.

- Sovereign DeepTech funds structured to reinforce coherence, not inflate valuations, by funding connections between research institutions, pilot facilities, and first adopters.

Medium-term actions focus on scale and capital efficiency:

- Incentives for modular manufacturing to reduce retooling time and lower exposure during early deployment.

- Cross-border industrial corridors to share production capacity and reduce the need for premature domestic scale.

- Linking education systems to manufacturing intelligence so talent supply evolves alongside production systems rather than lagging them.

Long-term measures focus on durability:

- Readiness governance that persists beyond political cycles to maintain confidence in long-horizon investment.

- Financing models linked to coherence rather than project count to direct capital toward systems that renew themselves.

- Embedding readiness considerations into trade and diplomatic frameworks to reduce policy volatility and improve predictability for cross-border capital deployment.

For investors, the signal is clear. Coherent policy environments can reduce variance around execution and timing. Fragmented policy environments push risk downstream, where it is more expensive to absorb. Agna Ascent provides a way to distinguish between policy that accelerates capability and policy that merely signals intent.

Risks and limitations

Agna Ascent is designed to improve judgment, not eliminate uncertainty. Its value lies in making structural risks visible earlier, but several residual risks remain that investors must actively monitor.

Data quality and comparability remain uneven across countries and sectors. R&D intensity can include or exclude defence spending. Manufacturing capability can be measured by output, value, or adaptability. Market adoption data can be delayed or opaque. These inconsistencies introduce noise into readiness indicators. The mitigation is triangulation, validating signals across multiple sources and interpreting trends rather than single data points.

Policy timing introduces another layer of risk. Readiness evolves on multi-year cycles, while policy incentives can shift abruptly. Funding announcements often precede measurable capability by several years. Rapid reversals increase coordination risk and distort apparent progress. For investors, this means treating early policy momentum as a monitoring condition rather than a green light until downstream effects appear.

Sectoral asymmetry is structural. Technologies mature at different speeds. Biotechnology requires long validation cycles. Digital systems move faster but depend heavily on adoption infrastructure. Applying uniform expectations across sectors can misprice risk. The framework addresses this through sector-specific weighting, but interpretation still requires contextual judgment.

Quantitative indicators also have limits. Culture, leadership quality, and institutional trust influence execution but resist measurement. Overreliance on scores can obscure these factors. The framework pairs metrics with expert assessment and ground-level validation. Where qualitative signals conflict with quantitative trends, divergence is treated as a warning rather than resolved mechanically.

Strategic sensitivity constrains transparency in defence and dual-use domains. Some readiness signals cannot be disclosed without compromising security. This creates blind spots that must be managed through aggregate indicators and restricted disclosure. Investors should assume higher uncertainty in these domains and adjust capital structure accordingly.

For public use, the framework is best treated as a structured lens and checklist. For investment use, it should be paired with domain diligence and on-the-ground validation.pots that must be managed through aggregate indicators and restricted disclosure. Investors should assume higher uncertainty in these domains and adjust capital structure accordingly.

For public use, the framework is best treated as a structured lens and checklist. For investment use, it should be paired with domain diligence and on-the-ground validation.

Conclusion: readiness as alignment, and alignment as investability

Agna Ascent reframes DeepTech readiness from a project-level checkpoint into a system-level discipline. It shows how discovery, production, and adoption must move in rhythm for innovation to sustain itself under real capital constraints. The framework does not ask whether a technology works. It asks whether the system around it can carry it forward without distortion.

Technology Readiness reflects how a nation discovers. Manufacturing Readiness reflects how it builds. Commercial Readiness reflects how it absorbs and sustains. When these dimensions advance together, innovation compounds. When they diverge, progress appears strong until capital is already exposed.

The DeepTech trilemma of research depth, industrial flexibility, and market continuity is not abstract. It is a dominant source of timing error, capital inefficiency, and dependency risk in modern technology investing. Agna Ascent makes this trilemma legible. It turns imbalance into an early signal rather than a late surprise.

For investors, the advantage is practical. The framework sharpens judgment around when to commit, when to stage exposure, and when to wait. It distinguishes proof-of-concept from investability. It surfaces non-technical blockers before they harden into delays or dilution. It shifts focus from headline maturity to structural readiness.

The East–West Corridor extends this logic beyond borders. By linking complementary strengths across research, manufacturing, and markets, it reduces single-point dependency and improves capital efficiency. It replaces fragile self-sufficiency with distributed resilience.

Agna Ascent reflects our identity as investors focused on timing discipline, system coherence, and capital efficiency in DeepTech, rather than momentum-driven exposure to technical novelty.

The objective of Agna Ascent is not to predict winners. It is to avoid predictable failures. By making readiness relational, measurable, and decision-relevant, the framework enables earlier, clearer, and more defensible investment choices in DeepTech.

Sovereignty in innovation, and durability in returns, is unlikely to belong to those who move fastest. It will belong to those who align discovery with production, production with adoption, and ambition with system capacity. That alignment is the ascent.

Year-End Gratitude Note

Dear Everyone

Thank you for your trust, patience, and partnership.

Agna was founded with a clear conviction: to build a dedicated DeepTech investment platform from this region, grounded in first principles and built for long-term impact. In the absence of established regional benchmarks for a Deep Tech fund, we deliberately chose to build the platform from the ground up, rigorously and thoughtfully.

The past year has been foundational, and we are proud of the progress made this year across key dimensions:

(1) Regulatory and Institutional Readiness: We graduated from in-principal approval (IPA) to a full Category 3 license in DIFC, marking a critical milestone in Agna’s institutional maturity and regulatory readiness.

(2) Conviction-Led Investment Theses: We developed macro and functional investment theses across Defence, Data, Engineering, and Life Sciences. Each thesis is anchored to clearly defined, high-impact problem statements that guide where we intend to deploy capital and unlock value over the coming years.

(3) Operating Infrastructure: We built a robust operating backbone spanning physical infrastructure (revamped our DIFC office), regulatory infrastructure (best-in-class third-party partners, compliance frameworks, and account closures), and digital infrastructure (secure, compliant data and information flows).

(4) Investment Pipeline & Deal Engine: We established a cross-border deal engine covering India, the UAE, the US, Europe, and Israel. From a pipeline of 450+ companies, we have shortlisted a focused set of opportunities and intend to close these investments in the coming months.

(5) Strategic Partnerships & Ecosystem Access: We established partnerships across geo-intelligence, technical, strategic and academic domains, spanning India, the US, Europe and the UAE, reinforcing Agna’s ecosystem-led investment approach.

(6) Organisational Capital: Most importantly, our core team stayed together through the build phase, expanded selectively, and continues to grow as we capitalise the platform. Agna would not be where it is today without the resilience, alignment, and commitment of the team that stayed the course.

None of this progress would have been possible in isolation. Agna’s journey has been shaped by the strength of its ecosystem and the trust, collaboration, and conviction of partners who chose to walk this path with us. Your insights, support, and engagement have played a meaningful role in shaping the institution we are building, and we acknowledge that with deep gratitude.

As reflected in our December 2024 Museletter, FY25 was a year of churn, of Manthan. FY26 is about Karma, decisive outward action guided by our Dharma, our first-principles inner compass at Agna.

FY26 is also the year of Fire Horse, a period associated with energy, bold action, forward momentum and intensity. We intend to channel this energy into deploying capital with conviction, supporting the Deep Tech ecosystem, and monetising intellectual property across the East–West corridor.

We are entering a phase of execution, responsibility, and delivery. We look forward to working closely with you as long-term partners as we build, scale, and compound value together.

Thank you for being an essential part of the Agna ecosystem.

Wishing you and your loved ones a prosperous, healthy, and inspiring New Year ahead, one filled with purpose, progress, and shared success.

Listen to this Museletter

Questions? Feedback? Different perspective?

We invite you to engage with us and collaborate.

Warm Regards,

Team Agna

Click below to join our mailing list for The Agna Museletter.

Agna Capital Limited is regulated by the Dubai Financial Services Authority

- Agna Ascent is an internal, proprietary analytical framework developed by Agna to inform DeepTech investment judgment and is shared selectively for context, not as a public standard or benchmark. ↩︎